By Desmond Bredu, Head, Client Coverage SIMS

One of the most frequent buzzwords in personal finances is financial independence and financial freedom. Even though these words are frequently used, many people need to understand what they truly mean. In this article, I look at dissecting financial independence, how different it is from financial freedom and how we can, as individuals, accelerate achieving financial independence.

First, let’s take a step back and address the fundamental question of financial independence. My interactions with young people reveal that having so much money is what, to them, makes one financially independent. That is, however, only part of the story. Financial independence is simply having enough passive income to sustain your desired lifestyle indefinitely if your regular income is no longer coming in. For many, it means not relying on your “9-5” income.

This consideration highlights the fact that financial independence varies from person to person. The bottom line is to sustain your desired lifestyle. For someone receiving GHS 5,000 every month from their passive income, it will be enough to sustain their chosen lifestyle. For others, it is GHS 25,000 and even GHS 2,000. I have always maintained that personal finances are personal, and so is financial independence.

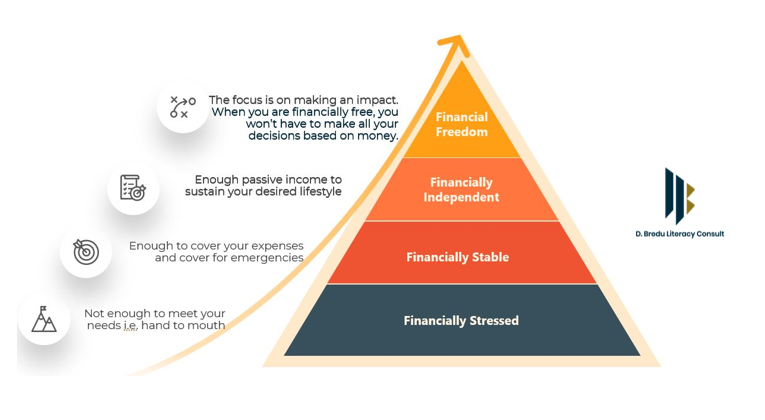

Now, let’s address the concept of financial freedom. Imagine a situation where money is not the major stressor in your life or relationships. When financially free, you won’t have to make all your decisions based on money. The focus is on making an impact. Thus, financial freedom is a step above financial independence. If we want to be financially free, a key milestone is financial independence.

Achieving financial independence is essential for several reasons. Firstly, for many people, job security is an illusion. Technology, regulations, and redundancies constantly impact our jobs. Many firms have conducted massive layoffs in the past three years after the COVID-19 pandemic. Even if any of these don’t happen to you, there is also the matter of retirement, as one cannot work throughout their entire life. Achieving financial independence also puts you in a better position to help others and amplify what makes you happy, whether travel, vacation or even early retirement. It is also important to highlight that financial independence is a journey; it doesn’t happen overnight. Achieving financial independence is a gradual process which requires consistent effort, discipline, and patience. There are no shortcuts to true financial independence. A visual representation of this journey makes it easier to appreciate these concepts.

Having set the scene, let’s explore how we can accelerate achieving financial independence, whether you are in the financially stressed or financially stable stage.

Visualize where you want to be: Often, the first step in any journey is to envisage the destination. This stage is about asking yourself what financial independence means to you. What is the magic number that would be enough for you? What timeframe are you looking at achieving your goal of being financially independent? Remember that this differs from person to person. An example is to “retire at 50 years, move back to my hometown and care for my farms or grandkids”. For another, it will be retiring at age 45 from active employment and travelling the world. This clarity will guide you throughout your journey, helping you stay focused and motivated.

Start Planning Towards It: Once you have a clear vision, the next step is to start. This begins with an honest self-assessment of your financial situation and what you must do to achieve the desired financial independence. What are the assets that are generating your income? What are your liabilities or debts you need to clear? Break down your long-term objectives into smaller, actionable steps and detailed timelines for reaching milestones. Having smaller actionable steps towards a goal motivates me to chalk the subsequent little success towards my main goal.

Budget and Smart Spending: Budgeting is one of the topical issues in literature. It is summarised as spending less than you earn. There are many ways and recommended principles that should guide you. It’s important to reiterate that “personal finances are personal”, and you need to find the type of budgeting and the formula that works best for you. You may adopt the 50:30:20 if you are a beginner on this budgeting journey. This means that 50% of your income should go into your fixed expenses, 30% to your variable costs, and 20% to your savings and investments. To accelerate your journey to financial independence, it is essential to increase the allocation to savings and investment by reducing your variable expenses and then your fixed costs. All things being equal, the more income you can save or invest towards your financial independence, the quicker you may get there.

Increase your income/ earnings: This is critical to accelerating financial independence. Having one source of income will hamper the extent to which you can be financially independent. Assess how you can harness your skills into profitable ventures and businesses to complement your primary source of income. Increasing your income could mean pursuing further education or certifications, starting a side hustle, or investing in your skills to advance your career.

Invest wisely: The fundamental tenet of financial independence is getting enough passive income to sustain your desired lifestyle. One way of earning passive income is through investments, which are financial or non-financial assets. Some financial assets include bonds, unit trusts, and equity. In contrast, non-financial assets could be a business or property from which you earn rental income. It is essential to consider your risk tolerance when choosing what asset or investment you undertake. Again, financial independence is a journey, and as such, when investing, you should be focused on something other than get-rich-quick schemes and avoid taking unnecessary risks.

Consider your career: Your career trajectory significantly impacts your journey towards financial independence. Are there growth opportunities and potential for increasing your income within your chosen field? How stable is the income from your career? Furthermore, your career geographic location can impact your financial independence goals due to variations in the cost of living, taxes, and overall job market conditions. Being in an environment where people are generally underpaid will affect your ability to be financially independent. As such, consider whether further education, skill development, or a career change could align better with your long-term financial goals and accelerate achieving your aspirations.

Continuously assess your financial situation: As your situation changes, you must change your strategy. If you have been able to pay off your debt, then it may be time to increase the allocation of your income to investments. Furthermore, we live in a dynamic and ever-changing world, so we must monitor how these changes affect our everyday lives and financial future.

It is essential that the approaches described above may be iterative and may also not follow a linear direction. It is important also to emphasize that personal finances are personal, and these strategies may not be exhaustive. Nonetheless, following these steps or strategies while continuously refining our approach will help build a more secure and fulfilling future and accelerate our path towards financial independence. In my subsequent articles, I will address some myths and the pitfalls or challenges to achieving financial independence.