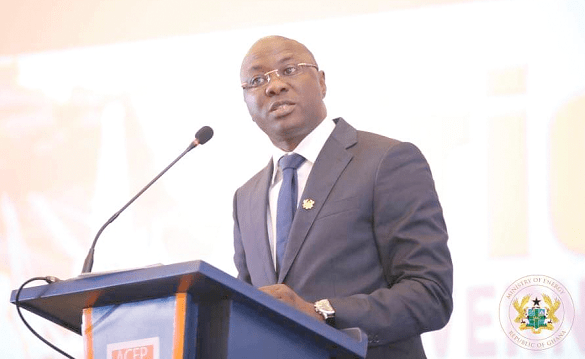

Minister for Finance Dr. Mohammed Amin Adam has announced that government of Ghana has finalised an agreement with Independent Power Producers (IPPs) to restructure arrears following six years of marathon negotiations.

The agreement, according to Dr. Amin Adam, includes the IPPs accepting a reduction in their claims (haircut), also allowing the government to spread payment over a five-year period.

“The negotiations have been going on for six years, and I am happy to announce that last week, l closed the negotiations with the IPPs,” the Finance Minister revealed.

According to him, the deal, which has been closed with some four IPPs, has yielded significant fiscal relief.

“We have closed it, and we have restructured the arrears of the independent power producers in Ghana, particularly the four major independent power producers in Ghana, [in a way] that has brought us some significant haircut or discount and that now allows us to spread the balance over five years or above.”

Dr. Amin Adam also said that “the problem that Ghana’s energy sector is faced with is now under control. The ECG [Electricity Company of Ghana] managing director is here, and he will confirm that we will stop interruption in power supply in order to provide reliable power for industry to thrive, so we can support the growth efforts of our economy.”

Ghana’s energy sector

Ghana’s energy sector is a debt making-machine, accumulating approximately $1 billion in debt annually, with around $500 million stemming from excess capacity charges.

According to a 2023 IMF assessment of Ghana’s energy sector, the West African nation has “almost doubled electricity tariffs over the past year to bring them close to the cost recovery level, but distribution and commercial losses persist.”

In fact, below-cost-recovery tariffs (usually as a result of exchange rate fluctuations), distribution and recovery losses, and excess capacity combined with take-or-pay contracts have led to large financial shortfalls over the past few years. By end-2022, the IMF estimated Ghana’s outstanding energy sector debt had reached $1.6 billion owed mainly to IPPs and fuel suppliers, and was nearing $2 billion.

In IMF’s assessment, “the government continued to accumulate payables during the first half of [2023], hence breaching the related program indicative target”.

It stressed that non-energy sector payables declined, but energy sector payables increased due to low recoveries in the sector, tight financing conditions, and pending negotiations with Independent Power Producers (IPPs).

During foreign exchange crises, the energy sector faces challenges due to the majority of power generation costs being in dollars while revenue is primarily in cedis, resulting in significant exchange losses during debt settlements.

According to the World Bank, Ghana incurs losses of over $680 million yearly due to load shedding or power outages.

The Electricity Company of Ghana (ECG) recently disclosed that it issued over 100 power outage notifications in the first two and a half months of this year, primarily due to maintenance activities.